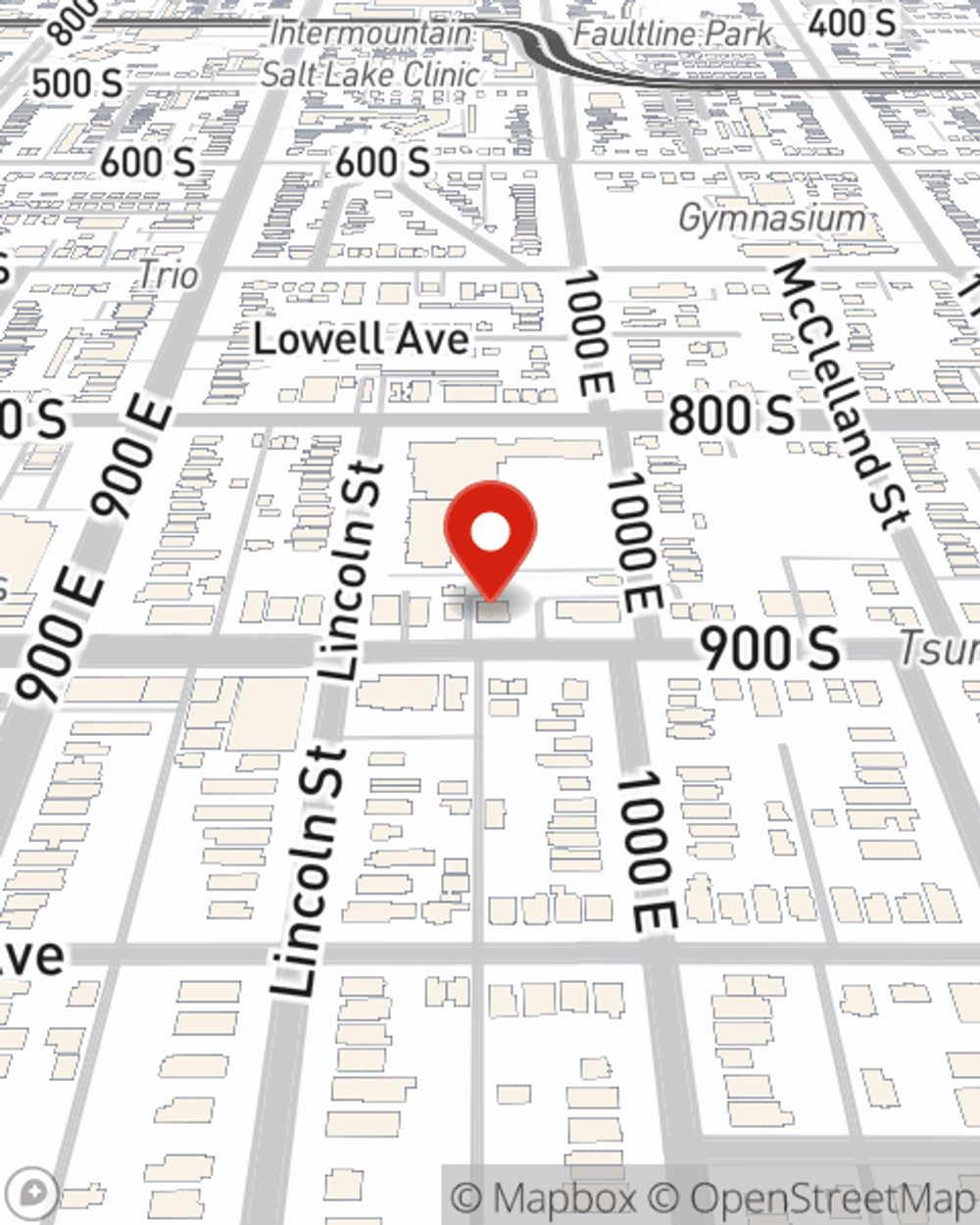

Homeowners Insurance in and around Salt Lake City

Protect what's important from catastrophe.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- 9th & 9th

- Downtown Salt Lake

- Foothills

- Sugar House

- University of Utah

- South Salt Lake

- The Avenues

- Liberty Wells

- Capitol Hill

- East Bench

- Canyon Rim

- Millcreek

- North Salt Lake

- Westminster College

- Riverton

Welcome Home, With State Farm Insurance

Your home and property have monetary value. Your home is more than just a roof over your head. It’s all the memories attached to every room. Doing what you can to keep your home protected just makes sense! That's why one of the most sensible steps is to get excellent homeowners insurance from State Farm.

Protect what's important from catastrophe.

Help protect your home with the right insurance for you.

Safeguard Your Greatest Asset

For insurance that can help protect both your home and your memorabilia, State Farm has options. Agent Juan Amoros's team is happy to help you set up a policy today!

Your home is important, but unfortunately, the unforeseeable circumstance may occur. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Juan Amoros can help you get the home coverage you need!

Have More Questions About Homeowners Insurance?

Call Juan at (801) 961-7000 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to get rid of nuisance deer

How to get rid of nuisance deer

Nuisance deer can cause major property damage. Learn tips for deterring deer, such as using repellents, fencing, scare tactics, and deer resistant plants.

The importance of safety glasses and when to wear them

The importance of safety glasses and when to wear them

Learn about the importance of wearing eye protection, the different types and features that can help increase your safety and prevent eye injury.

Juan Amoros

State Farm® Insurance AgentSimple Insights®

How to get rid of nuisance deer

How to get rid of nuisance deer

Nuisance deer can cause major property damage. Learn tips for deterring deer, such as using repellents, fencing, scare tactics, and deer resistant plants.

The importance of safety glasses and when to wear them

The importance of safety glasses and when to wear them

Learn about the importance of wearing eye protection, the different types and features that can help increase your safety and prevent eye injury.